If I haven’t said this before (truth is, I probably have) let me say now. Cancer is a Whack-A-Mole Disease.

Just when one part of it comes under control, another aspect arises. In my case, the drugs I’m on are working to keep those rogue cells in check (good) but I’ve now got huge medical bills as a result (bad).

Part of the issue is the way Memorial Sloan Kettering chooses to bill my treatment as an outpatient procedure (which rakes in more money for them) rather than a doctor’s visit (which would only cost me $50).

That’s the problem with healthcare, you can’t really “shop” around for the best price. There’s no menu with options and costs. Instead, you go to your appointment, believing you’re going to be billed a $50 co-pay only to get a bill that has several zeros at the end (not including decimal points).

When I called billing to complain, I got a standard reply. “That’s how we bill it. You’ll have to check with your insurance company.”

I’ve called my insurance company, my insurance agent and a third party vendor that assesses insurance costs. All say it’s how the hospital is choosing to code it.

If everything stays as it is, I’ve just about blown through whatever money I had to spend getting into a clinical trial and I’m feeling panicked. With these drugs working, clinical trials are off the table. At some point they’ll stop working and, again, I’ll be looking to get into one, but I won’t be able to afford it.

Add that to the national debate going on at the moment about changing the Affordable Care Act which will also tie availability of treatment to my ability to pay. It’s a wonder I can sleep at night with the worry that’s consuming me.

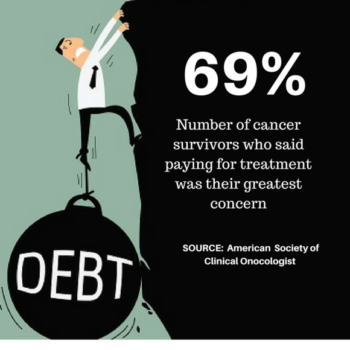

I’m not the only one who feels this way. According to results released during this year’s American Society of Clinical Oncology conference, the top concern reported by melanoma survivors was money, with 69% reporting that they were concerned about insurance and financial matters. The study found that:

- 57% depleted their savings

- 20% borrowed against or used retirement money

- 17% postponed filling prescriptions

- 13% skipped medicine dosages at least sometimes

So how do I choose to tackle it? As my mentor, Tina Jordan – who climbed out of $1 million in medical debt. I’ll tell her story tomorrow – reminded me, “I’m a journalist. Let me approach this like a journalist.”

Last week, I went straight to the top. I wrote a letter to MSK’s CEO Dr. Craig Thompson. I explained the issue, included copies of the bills and a synopsis of my insurance plan. I’ve learned from experience that CEO’s will direct it to the attention to someone at the top of the food chain, the vice president of billing most likely. Someone who has a different answer than “that’s just how we bill it.”

Tina gave me some ammunition as well. There are consumer protection laws in New York that prevent hospitals from “balance billing” which means coming after patients for more money than what they’ve agreed to pay based on their insurance contract. I’m keeping that info in my back pocket.

My goal at this point is to negotiate a discount so I’m paying what I thought I’d be paying. If billing won’t work with me, then I’ll apply for financial assistance. Tina did. She said even with gold standard health insurance and the lucrative jobs she and her husband had, she did qualify. That’s encouraging.

I don’t know how long it will take to resolve this. Already I’ve enlisted the help of a patient advocate offered up my my insurance agent. She’s survived Hodgkin’s Lymphoma, so she knows the deal.

I also look at it this way. As long as I owe Memorial Sloan Kettering money, they have skin in the game to keep me alive and well. In this, I’m hoping for a happy ending.